Jan. 07, 2025 /

HARRISBURG – Rep. Torren Ecker (R-Adams/Cumberland) joined his colleagues today for the swearing-in ceremony, formally kicking off the 2025-26 session in the Pennsylvania House of Representatives. He issued the following statement:

Jan. 07, 2025 /

![Heffley Takes Oath of Office]()

HARRISBURG – Rep. Doyle Heffley (R-Carbon) took the oath of office today to begin a new term in the Pennsylvania House of Representatives.

Jan. 07, 2025 /

HARRISBURG – Rep. Stephenie Scialabba (R-Butler) took the oath of office today in the House Chamber at the Pennsylvania State Capitol, kicking off her second term representing the 12th Legislative District.

Jan. 07, 2025 /

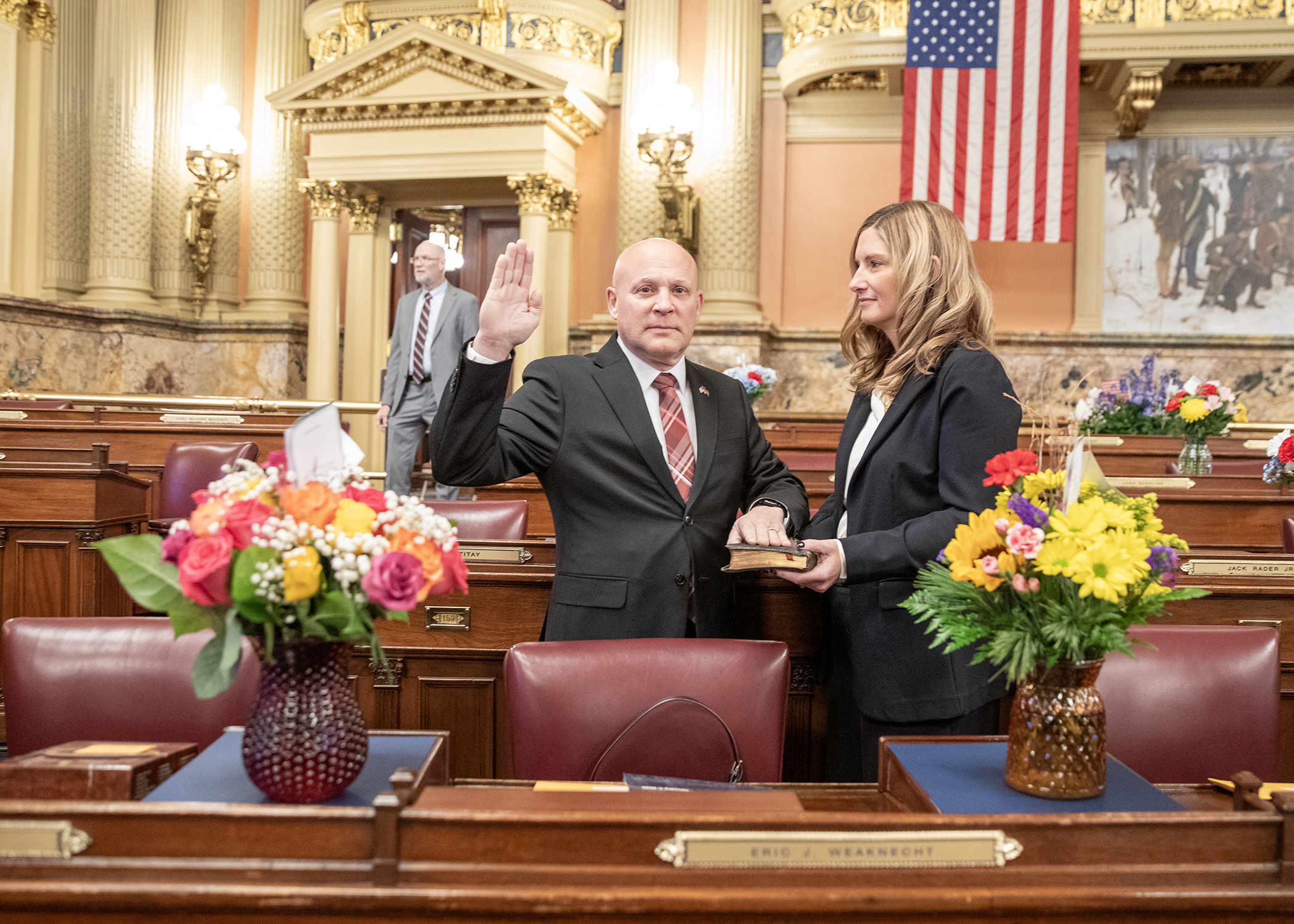

HARRISBURG – State Rep. Eric Weaknecht (R-Berks) today took the oath of office to begin his first term in the state House of Representatives serving the 5th House District which consists of the following municipalities in Berks County: the townships of Bethel, Bern, Centre, Heidelberg, Jefferson, Lower Heidelberg, Marion, North Heidelberg, Ontelaunee, Penn, Perry, South Heidelberg, Spring and Tulpehocken; and the boroughs of Bernville, Centerport, Leesport, Robesonia, Shoemakersville, Wernersville and Womelsdorf.

Jan. 07, 2025 /

![Tomlinson Sworn in For Third Full Term]()

HARRISBURG – Rep. K.C. Tomlinson (R-Bucks) was sworn in today to serve the people of the 18th District in Bucks County. She is serving her third full term, following a special election in March 2020.

Jan. 07, 2025 /

HARRISBURG – Reps. Tina Pickett (R-Bradford/Wyoming) and Clint Owlett (R-Tioga/Bradford) took the oath of office today to continue their service to the people of Bradford County in the Pennsylvania House of Representatives.

Jan. 07, 2025 /

HARRISBURG – Rep. Clint Owlett (R-Tioga/Bradford) took the oath of office today to continue his service to the people of Tioga County in the Pennsylvania House of Representatives for the 2025-26 Legislative Session.

Jan. 07, 2025 /

HARRISBURG – Rep. Donna Scheuren (R-Montgomery) was sworn in today for her second term as representative of the 147th District. The 147th covers portions of Western Montgomery County, including the townships of Franconia (part), Lower and Upper Salford, Lower and Upper Frederick, New Hanover, Douglass and Upper Pottsgrove.

Jan. 07, 2025 /

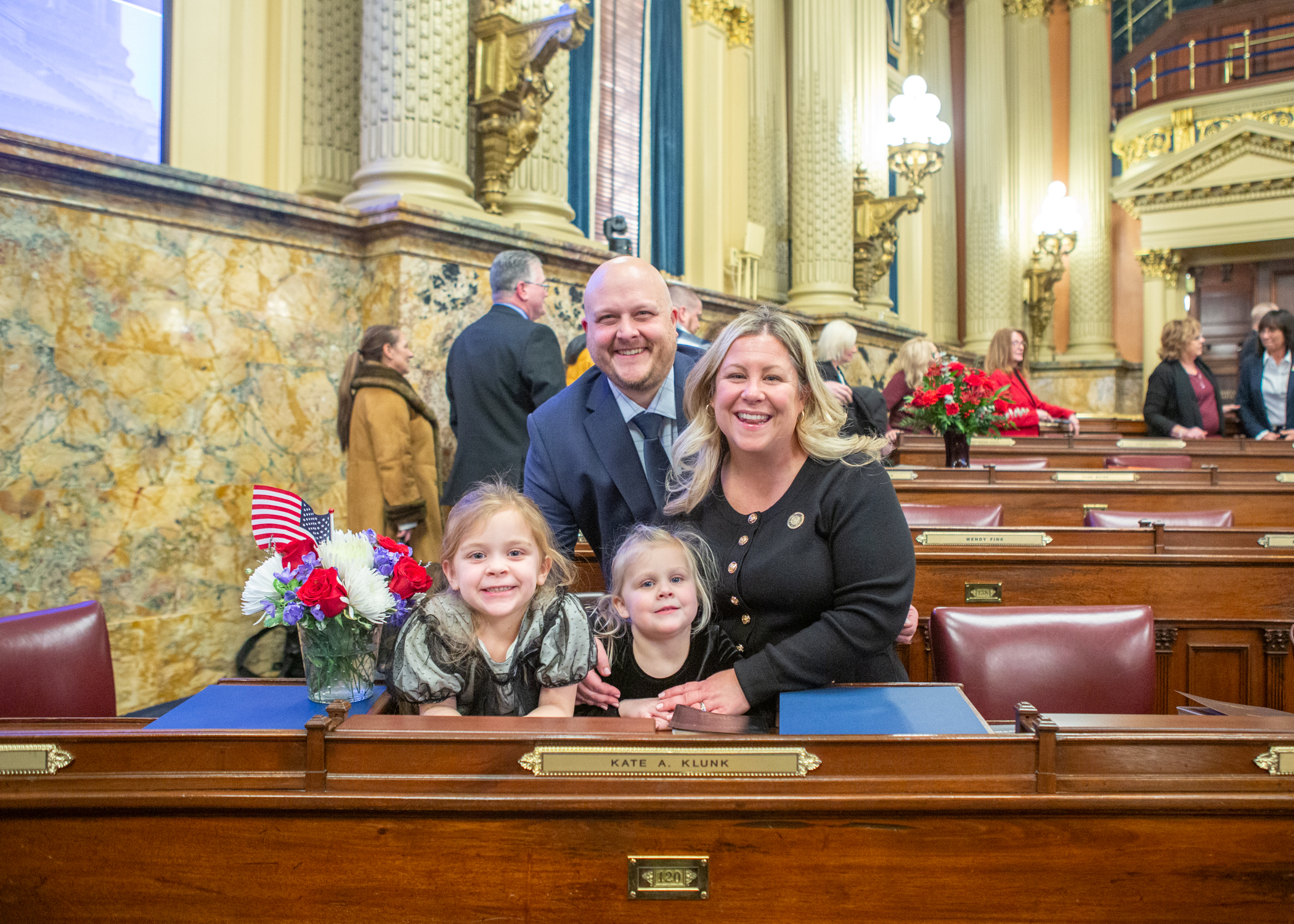

HARRISBURG — Rep. Kate Klunk (R-Hanover) took the oath of office Tuesday to begin her sixth term in the Pennsylvania House of Representatives. In addition to serving as representative of the 169th District, Klunk will also serve as the Republican chair of the House Children and Youth Committee this session.

Jan. 07, 2025 /

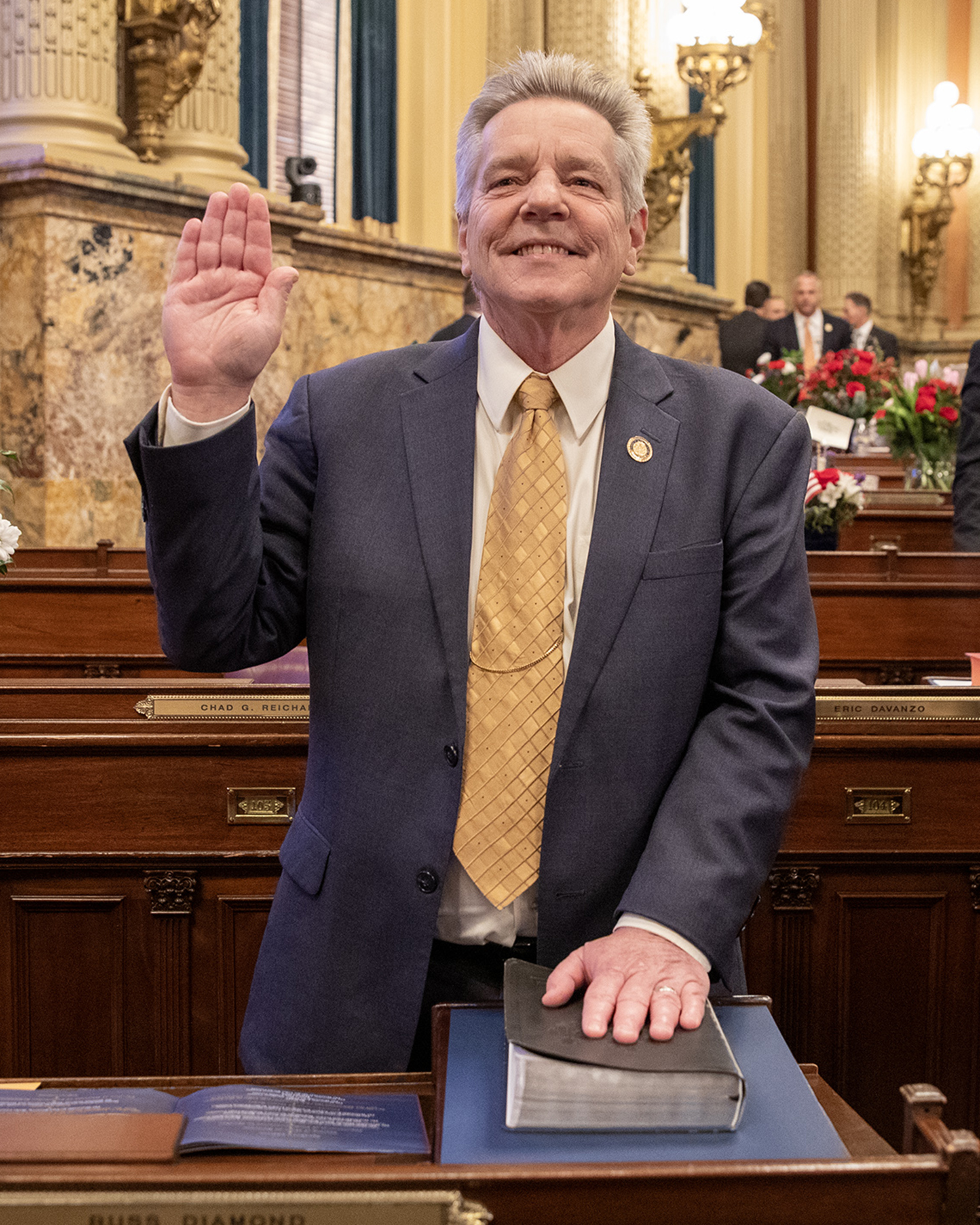

JONESTOWN – Rep. Russ Diamond (R-Lebanon) took the oath of office Tuesday, Jan. 7

Jan. 07, 2025 /

![Hogan Sworn in for Second Term]()

HARRISBURG – Rep. Joe Hogan (R-Bucks) was sworn in today for his second term as State Representative. Hogan represents the 142nd District, which includes the municipalities of Lower Southampton Township, Langhorne Manor, Langhorne Borough, Penndel Borough, as well as portions of Middletown and Northampton Townships.

Jan. 07, 2025 /

![Bernstine Takes Oath of Office, Committed to Protecting Second Amendment Rights, Fighting Wasteful Spending]()

HARRISBURG – Rep. Aaron Bernstine (R-Butler/Lawrence) was sworn into office today at the state Capitol, proudly assuming his role as the representative for the 8th Legislative District.

Jan. 07, 2025 /

![Schmitt Starts Fourth Term Representing the People of the 79th Legislative District]()

HARRISBURG – Joined by colleagues of the House of Representatives, Rep. Lou Schmitt (R-Blair) took the oath of office today, officially beginning his fourth term representing residents of the 78th Legislative District. He issued the following statement:

Jan. 06, 2025 /

![Rasel to Take Oath of Office Jan. 7]()

WHAT: Rep. Brian Rasel (R-Westmoreland) will take the oath of office for his first term as state representative of the 56th Legislative District.

Jan. 06, 2025 /

![Rowe to Take Oath of Office Jan. 7]()

WHAT: Rep. David H. Rowe (R-Snyder/Juniata/Mifflin/Union), chairman of the House Policy Committee, will be sworn into office for a fourth term, proudly serving the 85th Legislative District.

Jan. 06, 2025 /

![Anderson to Take Oath of Office]()

WHAT: Rep. Marc Anderson (R-York) will take the oath of office as state representative of the 92nd Legislative District.

Jan. 06, 2025 /

![Bashline to Take Oath of Office Jan. 7]()

WHAT: Rep. Josh Bashline (R-Clarion/Armstrong) will take the oath of office as state representative of the 63rd Legislative District.

Jan. 03, 2025 /

![Olsommer to Take Oath of Office]()

WHAT: Rep. Jeff Olsommer (R-Wayne/Pike) will take the oath of office as state representative in the 139th Legislative District.

Jan. 03, 2025 /

![Fritz to Take Oath of Office]()

WHAT: Rep. Jonathan Fritz (R-Susquehanna/Wayne) will take the oath of office as state representative in the 111th Legislative District.

Jan. 03, 2025 /

![D’Orsie to Take Oath of Office]()

WHAT: Rep. Joe D’Orsie (R-Manchester) will take the oath of office as state representative in the 47th Legislative District.